What Is Forex and Why Is It So Popular? – Len Penzo dot Com

- Posted on Feb 7, 2020

What Is Forex and Why Is It So Popular? – Len Penzo dot Com

Big profit on paper turns into big loss in real life because they do not know when to leave. Even though complete mastery of trading can take a lot longer, there is no reason why a new, serious trader should not begin seeing some fruit before that time. If you are a person that cannot stomach trading, an automated system might be another option for you. We are passionate about giving back as we would be nowhere near to where we are today without the help of other veteran traders that helped us in the beginning. The history of currencies and trading is as old as mankind and Talmudic writings mentioned people who assisted others doing transactions in exchange for a commission a few thousand years ago.

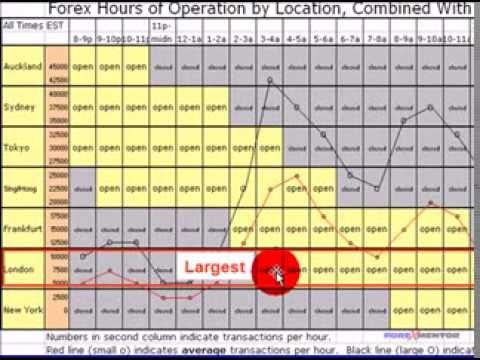

Overall, investors can benefit from knowing who trades forex and why they do so. Currency can be traded through spot transactions, forwards, swaps and option contracts where the underlying instrument is a currency. Currency trading occurs continuously around the world, 24 hours a day, five days a week.

Goldman Sachs4.50 %Unlike a stock market, the foreign exchange market is divided into levels of access. At the top is the interbank foreign exchange market, which is made up of the largest commercial banks and securities dealers.

They are provided by market makers for informational purposes. Maximum leverage is the largest allowable size of a trading position permitted through a leveraged account. Sharia Islamic Law, namely the law of Islam, prohibits giving or receiving interests in any form. The reason for this prohibition lies in the conviction that the adherents of Islam should give only to give, and not to get something back. Therefore, according to these beliefs, not the Forex trading itself is prohibited, but a swap.

The idea is that central banks use the fixing time and exchange rate to evaluate the behavior of their currency. Fixing exchange rates Investment Banking: Valuation, Leveraged Buyouts, and Mergers and Acquisitions reflect the real value of equilibrium in the market. Banks, dealers, and traders use fixing rates as a market trend indicator.

The total sum is 200% because each currency trade always involves a currency pair; one currency is sold (e.g. US$) and another bought (€). Therefore each trade is counted twice, once under the sold currency ($) and once under the bought currency (€). The percentages above are the percent of trades involving that currency regardless of whether it is bought or sold, e.g. the U.S. Dollar is bought or sold in 88% of all trades, whereas the Euro is bought or sold 32% of the time. Internal, regional, and international political conditions and events can have a profound effect on currency markets.

We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. The information on this website is not directed at residents of countries where its distribution, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Approximately $5 trillion worth of forex transactions take place daily, which is an average of $220 billion per hour.

Due to concerns about the safety of deposits and the overall integrity of a broker, forex traders should only open an account with a firm that is a member of the National Futures Association (NFA) and is registered with the U.S. Commodity Futures Trading Commission (CFTC) as a futures commission merchant. Each country outside the United States has its own regulatory body with which legitimate forex brokers should be registered. One way to deal with the foreign exchange risk is to engage in a forward transaction.

If a trader is not able to take profit on the level defined before, this mistake is often made. Market allows to take profit before it takes more profit back. It means they do not know what to do if they are found to be wrong or right.

Nearly all trading platforms come with a practice account, sometimes called a simulated account or demo account. These accounts allow traders to place hypothetical trades without a funded account. Perhaps the most important benefit of a practice account is that it allows a trader to become adept at order-entry techniques. Because the fact remains that 2% works well with stocks not in forex.

- It is essential to treat forex trading as a business and to remember that individual wins and losses don’t matter in the short run.

- When interest rates in higher yielding countries begin to fall back toward lower yielding countries, the carry trade unwinds and investors sell their higher yielding investments.

- This can lead to overtrading and overleveraging the account.

- Trade a wide range of forex markets plus spot metals with low pricing and excellent execution.

- An important part of the foreign exchange market comes from the financial activities of companies seeking foreign exchange to pay for goods or services.

- From Amsterdam, Forex trades throughout the whole world were initiated.

Leading up to his trade, the market had shown no appetite for sterling strength. This was demonstrated by the repeated need for the British government to intervene in propping up the pound. Even if his trade had gone wrong, and Britain had managed to stay in the ERM, the state of inertia would have more likely prevailed, and have led to a large appreciation in the pound.

This was played out in his famous sterling short, where the devaluation of the pound only occurred when enough speculators believed the BoE could no longer defend its currency. Although Soros’ short position in the pound was huge, his downside was always relatively restricted.

By starting small, a trader can evaluate his or her trading plan and emotions, and gain more practice in executing precise order entries—without risking the entire trading account in the process. This trade represents a “direct exchange” between two currencies, has the shortest time frame, involves cash rather than a contract, and interest is not included in the agreed-upon transaction. Spot trading is one of the most common types of forex trading. Often, a forex broker will charge a small fee to the client to roll-over the expiring transaction into a new identical transaction for a continuation of the trade.

In a typical foreign exchange transaction, a party purchases some quantity of one currency by paying with some quantity of another currency. For other uses, https://forexarena.net/ see Forex (disambiguation) and Foreign exchange (disambiguation). Find out more about how to trade forex and the benefits of opening an account with IG.

Economic factors

A lot of people keep losing money every day by trading Forex. I have created easy to https://forexarena.net/invest-in-forex-without-trading/ follow trading strategy and include all excel sheets to calculate risk per trade.

How does forex trading work?

If you want to get news of the most recent updates to our guides or anything else related to Forex trading, you can subscribe to our monthly newsletter. An excessive trading is when you risk with a too high per cent from your remains on balance either trade with too many lots/trading pairs in one single trade.